Covered Document: Reporting on TCFD recommendations: Guidance on Climate Disclosures

Date of Announcement: 5 November 2021

On 5 November 2021, the Hong Kong Stock Exchange published “Reporting on TCFD recommendations: Guidance on Climate Disclosures”. It is the first major step taken by Hong Kong following the announcing of the Green and Sustainable Finance Cross-Agency Steering Group that climate-related disclosures aligned to the TCFD recommendations will be mandatory across relevant sectors no later than 2025.

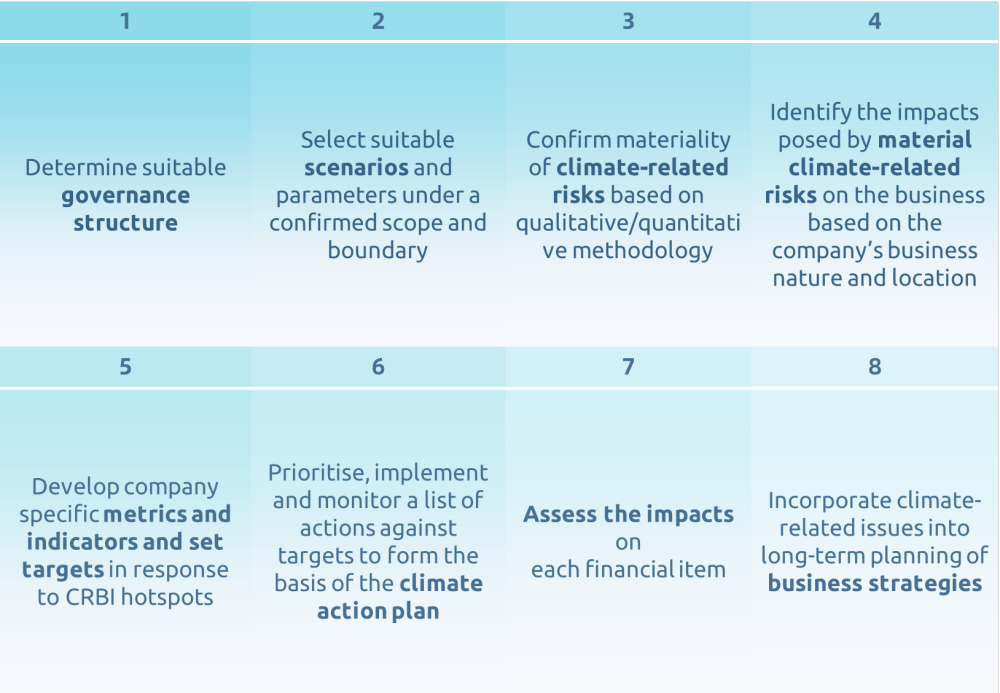

The guidance outlines eight steps a HKEX-listed company may take to assess and respond to the climate-related risks facing them and prepare corresponding TCFD-aligned disclosures.

Overall, the process goes from clarifying the key factors to planning and implementing.

Figure 1. Eight Steps to Respond to Climate-related Risks

Step 1 to 4: Climate Strategy in the Making

Becoming climate-ready is a top-down process and starts with determining the roles and responsibilities of a company’s board and management. The role of the board is to approve and monitor the company’s policies and mechanism to manage climate-related issues, while the task for the management is to implement the policies and execute the mechanism in an efficient and effective manner.

What follows is to formulate climate scenarios as climate-related risks greatly differ for companies in different sectors and geographical locations. The guidance encourages companies to consider two highly diverging scenarios which respectively represent the best and worst case, consider both physical and social-economic impacts arising from transition climate risks and make science-based estimates. Based on several mainstream scenarios published by IPCC and IEA, etc., the guidance defines two climate change scenarios: a stringent scenario (turquoise scenario) and a high emissions/business-as-usual scenario (brown scenario). Under the turquoise scenario, the globe is able to contain the temperature rise within 1.7℃ by 2060 and 1.8℃ by 2100, while under the brown scenario, the temperature rise might hit 2.4℃ by 2060 and 4.4℃ by 2100.

The guidance noted that major types of climate-related risks include “policy and legal risks”, “market and technology risks”, “reputation risks”, “acute physical risks”, and “chronic physical risks”. A company should identify the primary risks facing it through an internal review and holding discussions with stakeholders, and sort the risks by likelihood, impact, adaptability and recovery.

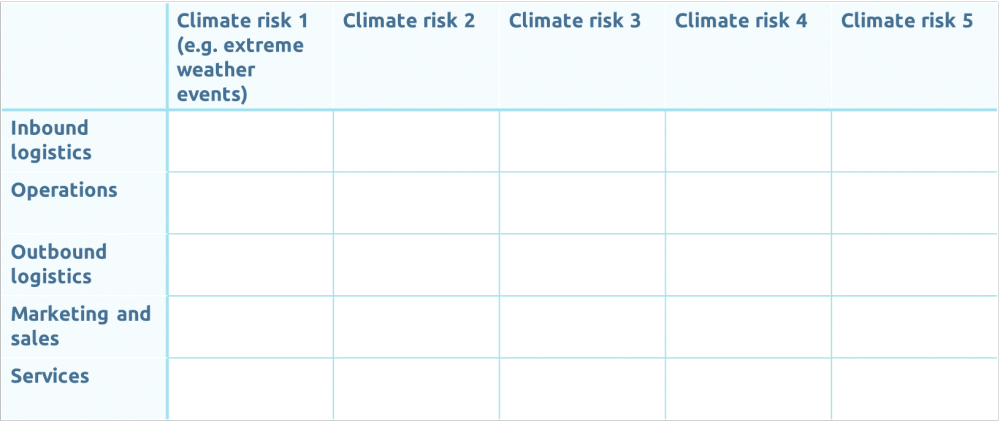

When the climate risks are identified, the company is supposed to map them into the different parts within its value chain, which, for all sectors, usually include inbound logistics (the movement of materials or products from suppliers to the company), operations, outbound logistics (the movement of products from the company to customers), marketing and sales and services. The outcome is suggested with a climate-related business impact (CRBI) scorecard.

Figure 2 CRBI Scorecard Example

Step 5 to 8: Becoming Climate-ready

Selecting insightful climate-related metrics and indicators and setting targets are crucial to quantifying the climate transition. The key metrics applicable to all sectors as the guidance suggests are greenhouse gas (GHG) emissions, carbon price, proportion of assets and/or business activities materially exposed to physical and transitional risks, and amount of expenditure or capital investment deployed toward climate-related risks and opportunities. However, the ultimate indicator is dependent on the sector in which the company belongs. For example, for a real estate firm, an insightful indicator could be the GHG emissions per gross floor area of rented space, while for a finance firm, an indicator that signs the GHG-intensity of its business is the GHG emissions per million-dollar loan portfolio.

Building on selected indicators and set targets, a company can figure out a list of actions that collectively form an action plan of the company. It is crucial to continuously review and monitor these actions as the conditions of the company, technological breakthroughs, and policy are ever-changing.

One central aim of ESG risk management is to avoid ESG risk factors turning into financial loss. Having identified the material climate risks, companies ought to evaluate how the risks will be reflected on their financial statements. Taking the finance sector for instance, stricter government regulations to tackle climate change can imply an increase in compliance cost, which is part of the operating expenses. As lenders tend to add a carbon footprint premium when determining a lending rate offered to a firm, finance firms whose investments cause greater GHG emissions may see a rise in financing costs.

The final step is to integrate climate-related impacts into business strategies to have an ongoing and effective climate-related risk management. In doing so, the guidance recommends a “five components” methodology, these are: corporate strengths, customer relationships, market segment, partnerships, and resource allocation.

Next Steps

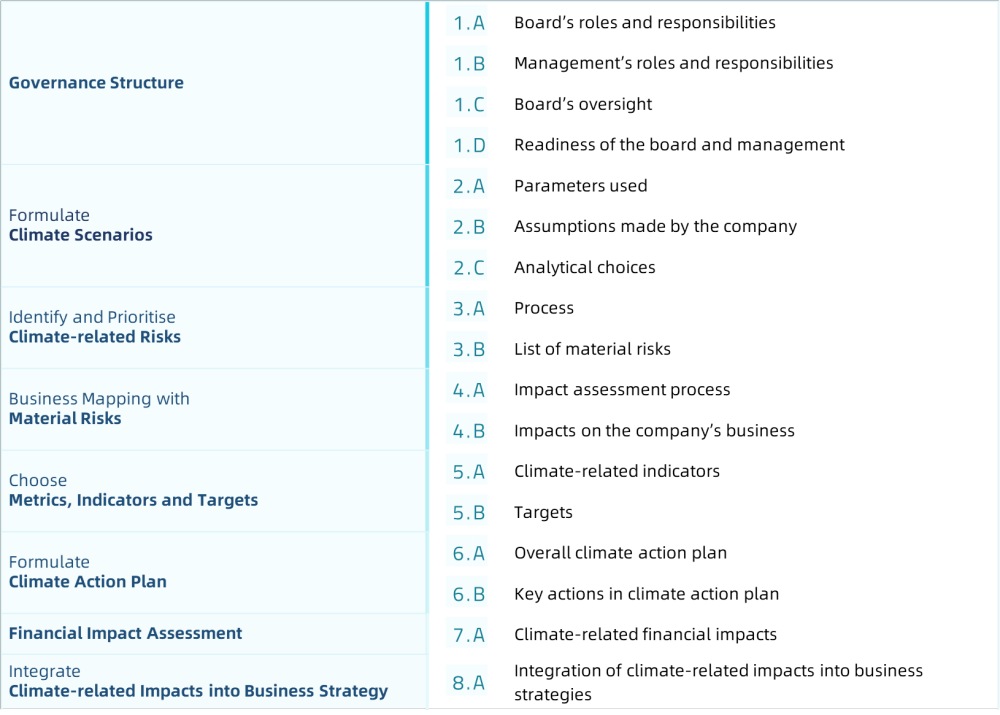

In each of the eight steps, the guidance suggests several key elements to disclose, these will form a company’s sound climate disclosures. The 17 key disclosure elements are as follows:

Figure 3. 17 Recommended Indicators to Disclose in the Guidance

Upon the release of this guidance, the HKEX noted that it would review its ESG reporting framework to improve its alignment with TCFD recommendations in the future. The exchange also seeks to make the framework more comprehensive by adopting other standards, including the standard(s) to be developed by the International Sustainability Standards Board under the International Financial Reporting Standards Foundation.

The overall ESG reporting rate has topped 95% across HKEX-listed companies, with the exchange’s “Comply or Explain” requirements regarding environmental and social disclosures, these requirements have incorporated certain key TCFD recommendations. However, major challenges remain when aiming to make the remaining companies compliant with disclosure requirements and enhancing the quality of current disclosures that will pave towards an alignment with TCFD recommendations.

Despite no regulatory force attached, this guidance is expected to help HKEX-listed companies adopt the existing requirements, specifically those that have recently launched IPOs.

However, the Exchange is said to further review its ESG reporting framework, it is unclear how this review will align with this guidance. It is essential for the Exchange to harmonize their various requirements as clarity is needed if listed companies are to be in compliance.