Key Takeaways:

- Over 8 million emission allowances have been traded since the start of the national emissions trading scheme (ETS) launched in Shanghai on July 16, 2021, with a turnover of over CNY 4 billion.

- Underdeveloped infrastructure and generous free emission allowances have led to inadequate liquidity on the world's largest carbon market.

- Price and daily volume will remain low before the final allocation of allowances are completed on 30 September. The daily volume is estimated to sit below 100,000 tonnes, while price will fluctuate between CNY 45 and 50.

- Given the eventual inclusion of eight carbon-intensive industries and the gradual reduction of free emission allowances, China's carbon price is bullishly expected to be around CNY 96-100 by 2030.

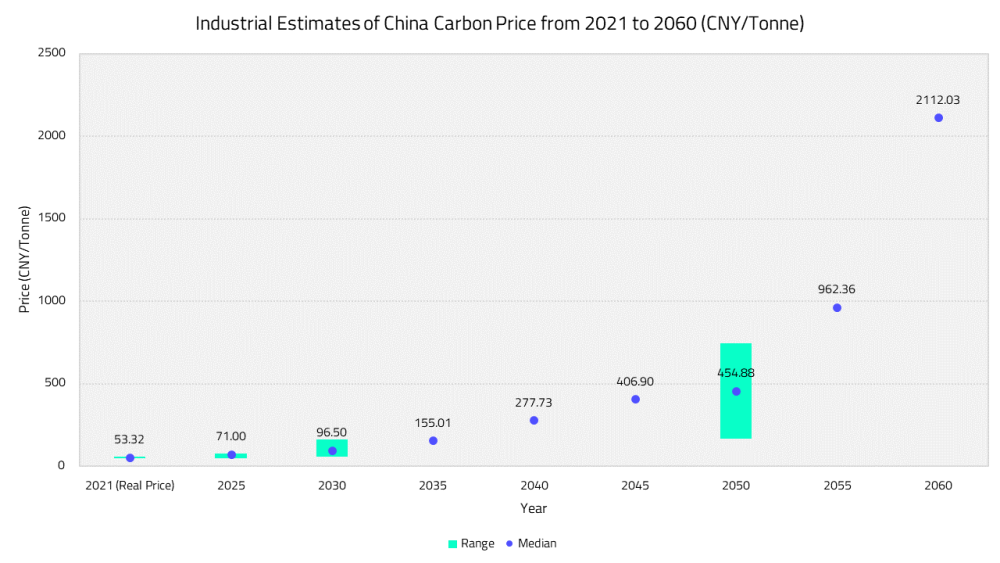

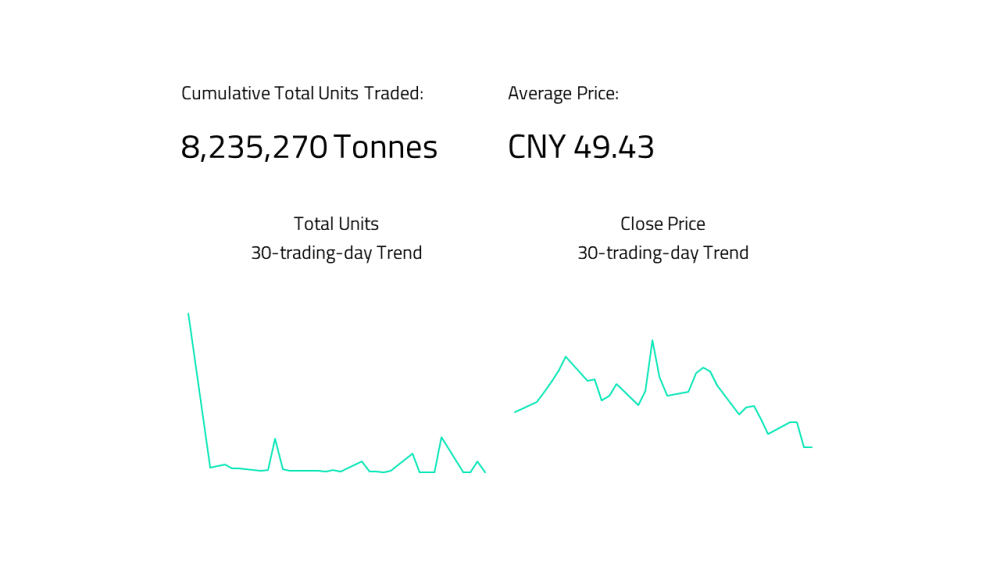

CEA 30-trading-day Data Summary

Source: Shanghai Environment and Energy Exchange, elaborated by MioTech

Starting off with a bang: CEA Trading Analysis

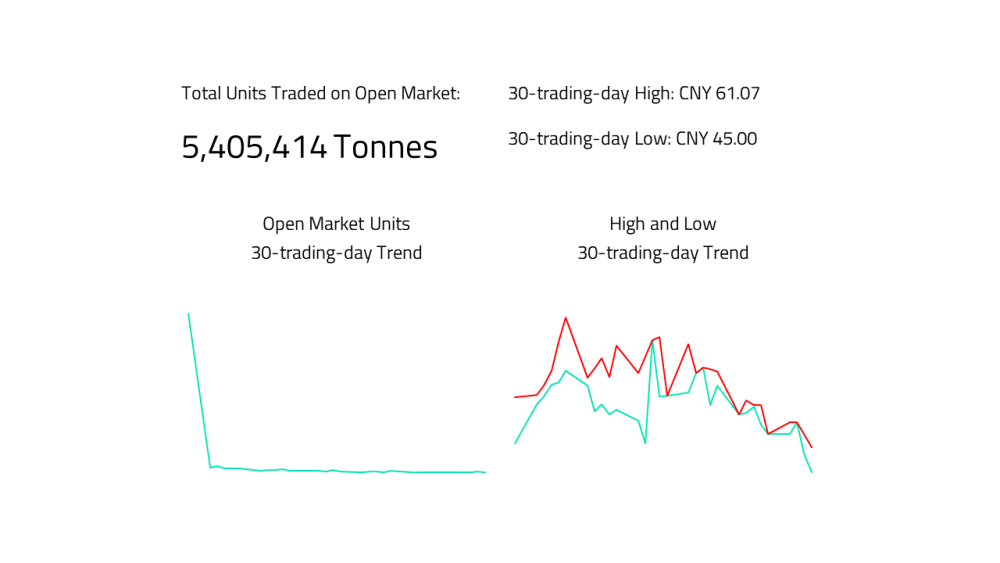

Figure 1 China National Carbon Market Trading Chart

26 August 2021 marks the 30th trading day after the national ETS officially launched on 16 July 2021. A total of 8,235,270 tonnes of emission allowance and CNY 407,109,136.45 were traded with an average price of CNY 49.43 per tonne, up by 2.98% from the initial price of CNY 48.00. Of them 5,405,414 tonnes of allowance were traded in the open market, bringing up a total trading value of CNY 280,339,442.73, with an average price of CNY 51.86.

Cool down after a hot opening

On 16 July 2021, the first trading day of China’s national carbon market, the price closed at CNY 51.23 per tonne, up from the initial price of CNY 48.00. On the first day 4,103,953 tonnes of allowance were traded, 49.83% of the total units traded in the first 30 trading days, amounting to CNY 210,230,053.25 of trading value, which is 51.64% of the first 30 trading days.

Higher first-day shares imply that little has been traded after the first day, which is seen in the numbers, as ex-first-day average trading volume stands at 142,459.21 per day. The most unattended day saw only 2,002 tonnes traded. The national ETS quenched after a big opening, which has caused questions over its trend going forward; a lax free allowance allocation mechanism may be to blame for such illiquidity[1-3].

In light of the state, Xiaoming Lai, Chairman of Shanghai Environment and Energy Exchange, noted on 13 August 2021 that two factors account for the downside of the national carbon market[4]:

- Of the 2,162 firms confirmed to participate in the market, only 1,600 had opened their accounts [4];

- Most firms to trade on the national market did not join a pilot market before and have no experience in emission-trading[4], which will incur some delay from training time.

Not enough liquidity failed to price carbon

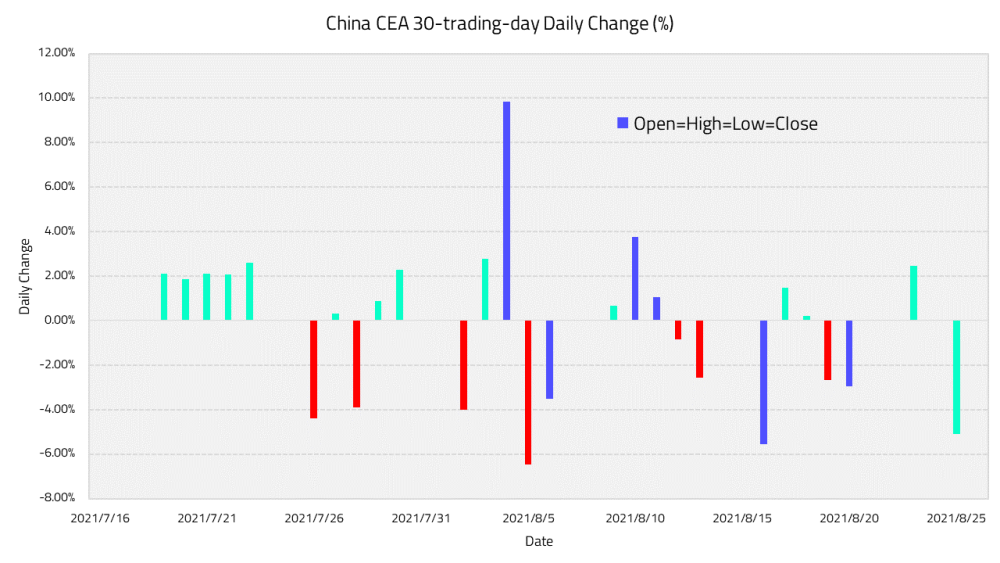

Declining trading volume means fewer participants. One consequence to be concerned about is the absence of proper price signals due to lack of liquidity. This has become pressingly significant since 2 August, the third week after the launch of the market. In six of the trading days from 2 to 26 August, there was only one number for open, high, low and close price. It is likely that only one deal was made in each of the days [1].

Table 1 Illiquidity of CEA in the First 30 Trading Days

Few deals being reached also led to volatile daily prices, as the prices are rather random in this case [1]. In the first 30 trading days, nine saw a rise of over 2%, three of which had the same open, high, low, and close prices. A price decreasing over 2% was seen in ten of these thirty days and in three of them, open, high, low and close prices were the same. Notably, the price was up by 9.84% to CNY 58.70 per tonne before it fell to 6.47% to CNY 54.90 on the next day.

Figure 2 China CEA 30-Trading-day Daily Change (%)

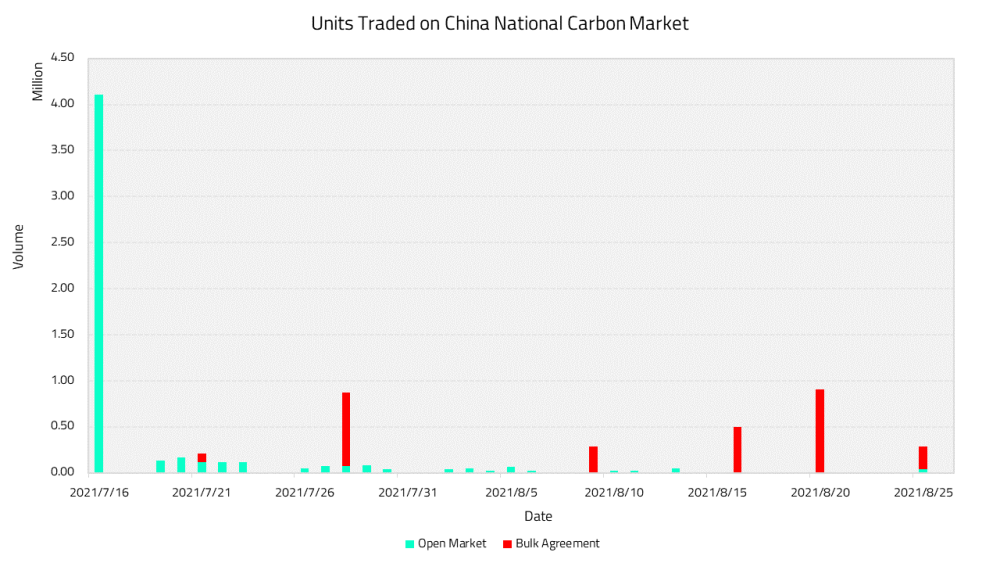

Bulk agreements become the theme

On China’s national carbon market, a transaction of less than 100,000 tonnes of carbon emission allowance can be reached via open market, while larger transactions of more than 100,000 tonnes require two parties to ink a bulk agreement[5]. From 16 July to 26 August 2021, six bulk agreements have been reached on the national ETS, enabling 2,829,856 tonnes of emission allowance to be traded and creating a total value of CNY 126,769,693.72, with an average price of CNY 44.80. This is lower than the average price on the open market by 13.61%; By 26 August, bulk agreements have altogether contributed to 34.36% of the total trading volume and 31.14% of the total trading value. Bulk agreements are the sources of major momentum when the open market became less dynamic. Higher level of instability is witnessed in bulk agreements. On 28 July 2021, the average price of the bulk agreement(s) was merely CNY 40.98, 21.94% lower than that day’s close price of CNY 52.50; whereas on 16 August 2021, bulk agreement(s) were reached at CNY 51.50 on average, even higher than the daily close price.

Table 2 Bulk Agreements of CEA Trade on China National Carbon Market in the First 30 Trading Days

Figure 3 Open Market and Bulk Trading on the China National ETS in the First 30 Trading Days

China National Carbon Market Price Outlook

Price to remain stable in the short run

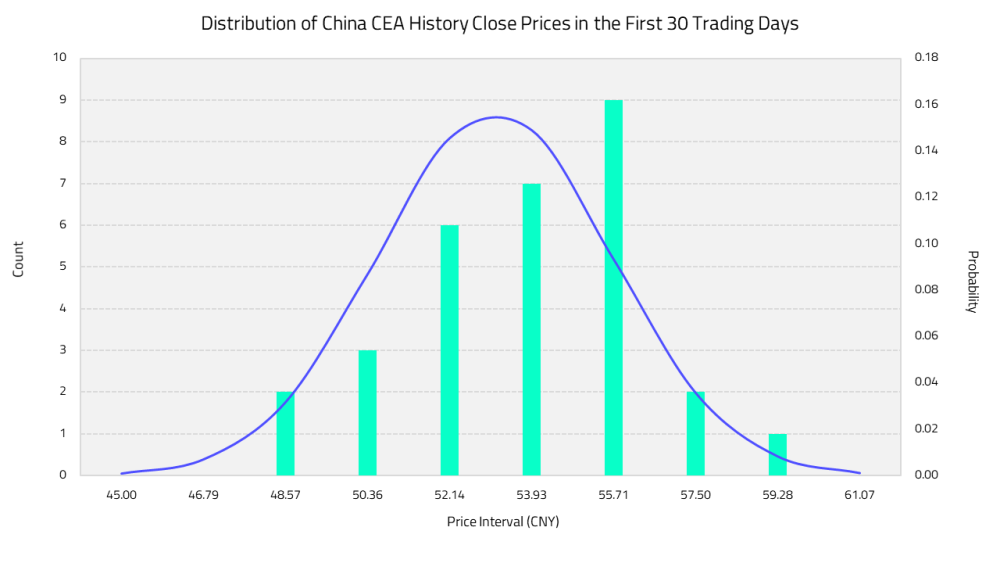

In its first 30 trading days, daily close prices usually fall between CNY 50.36 and 53.93. The lowest close price was CNY 47.64, slightly below the initial price of CNY 48.00, and the bulk agreement price was below the initial price in three of the days.

Figure 4 Distribution of China CEA History Close Prices in the First 30 Trading Days

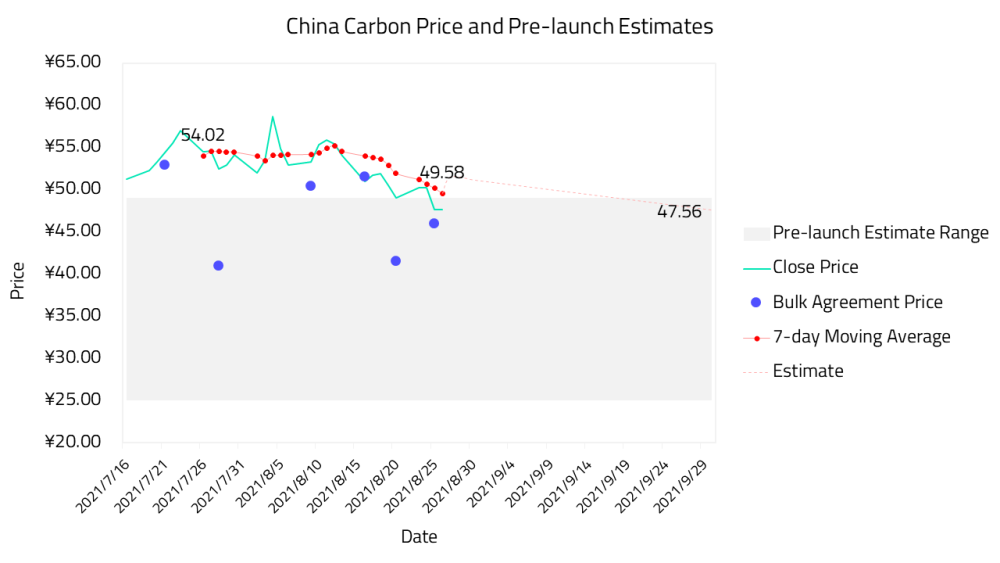

Notably, an initial price of CNY 48.00 was far higher than expected. Prior to national ETS launch, some power generation firms pinned their carbon prices at CNY 25.00 per tonne[5]; before the launch of the market, some institutions and organisations made estimates of China’s carbon price in 2020/21, including an estimate of CNY 49.00 from China Carbon Forum in their report “2020 China Carbon Pricing Survey”[6], an estimate of CNY 40 per tonne from Refinitiv [7], and an estimate of CNY 45.21 from the Institute of Energy, Environment and Economy, Tsinghua University[8].

Figure 5 China Carbon Price and Pre-launch Estimates

However, the real prices during the 30 trading days were generally higher at between 50.36 and 53.93, which implies that participants are rather optimistic about the prospects of the national ETS. However, issues like illiquidity had nonetheless caused price to drop steeply after 10 August. Accompanying usual daily trading volumes of less than 10,000 tonnes, the close price fell by 13.88% from CNY 55.32 on 10 August to CNY 47.64 on 26 August. Taking both sides into consideration, MioTech estimates that price will hover between CNY 45.00 and 50.00 in the short run with daily trading volume below 100,000 thousand in most occasions.

It is worth noting that what has been traded on the market is a planned allocation of free emission allowances and firms will not receive their actual free allowances from 2019 and 2020 until 30 September. It is predicted that the market will revitalize from 1 October to 31 December when firms prepare to surrender their allowances by year end[3, 9], while the compliance effects are not likely to be as strong on prices given the generous free allowances to be allocated and the limited obligations set to ease the burden on participants on the initial stages.

Bullish views eye CNY 100 per tonne by 2030

Despite the current inactive status of the market, positive signals from policies suggest carbon price will rise significantly over the next four decades. China’s goal to be carbon-neutral by 2060 is consistent with the goal under the “Paris Agreement” to limit the temperature rise to 1.5℃ compared to pre-industrial levels, while an analysis from Tsinghua University indicates that CNY 137.7 trillion in energy transition investment will be needed to achieve this [10]. Dewen Mei, President of Beijing Green Exchange, noted that given the volume of investments, a sophisticated market is pivotal to ensure the optimal distribution of resources[11] and a low carbon price will not be able to incentivize firms to participate in low-carbon transition. Thus, China will continue developing its national carbon market and provide preferential policies where needed.

“Reduced Supply”: Less allowance to be given in the 14th FYP

Table 3 Carbon Emission Allowance Allocation Mechanism for Power Plants

One of the reasons for an inactive national carbon market is that firms have abundant allocation of free allowances, like the EU ETS in its first phase. In the first phase of EU ETS from 2005 to 2007, the annual cap to be allocated for free was 2,058 million tonnes of CO2[14]. This, in combination with the global financial crisis that caused firms to reduce production and thus emit less greenhouse gases, made the price fall to zero in 2007[15]. Following that, the EU ETS allocated fewer allowances every year, replaced part of the free allocation with auction, and introduced Market Stability Reserve to resolve the issue with surplus allowances. China did the same in preparing its national ETS. The factors determining the amounts of free allowances for power generation firms to take part in the national ETS includes electricity/heat benchmark (tCO2/MWh), electricity/heat output, and an adjustment coefficient. Of them, the electricity benchmark weighs the heaviest in determining the allowances. The benchmarks were all reduced by 8.8%-13.6% depending on the capacity of a plant in a proposal released in November 2021 and in the final document released December 2021[12]. Fewer free allowances given to firms reduce their chance of having considerable surplus allowances and spur trading needs, which are signs of a bullish market.

The more the better: eight carbon-intensive industries to be covered in the 14th FYP

The national carbon market involves over 2,000 carbon-intensive power plants, which collectively emit more than 4 billion tonnes of CO2[16]. China sees the upcoming five years, or the 14th Five-year plan period, as a window of opportunity of reaching peak emissions by 2030 and plans to involve seven other carbon-intensive industries in the carbon market (power generation, steel, electrolytic aluminium, construction materials, petrochemical, chemical, paper and aviation)“[17, 18]. With all eight key industries included, emissions covered by the national ETS will top 5 billion tonnes[19], and 3 to 4 billion tonnes of them will be traded[20]. More entities, more coverage, and stricter allocation mechanisms will boost China’s national carbon market.

Table 4 Estimated Three Different Phases of China National Carbon Market

Global carbon price heralds price rise in China

On 29 October 2011, the National Development and Reform Commission (NDRC) announced a plan to establish pilot carbon markets in Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong and Shenzhen [22]. On 18 June 2013, Shenzhen became the first city in China to have a carbon market[23] when the EU ETS, Regional Greenhouse Gas Initiative (RGGI), New Zealand ETS, California Cap-and-Trade Program, Québec Cap-and-Trade System were already in operation[24]; After that, the Korea ETS officially began in 2015. With Brexit, British firms turned to the UK ETS from the EU ETS starting 2021[25].

According to the World Bank, 28 carbon markets were in operation in 1 April 2021, including eight pilot markets in China (the aforementioned seven and Fujian). Before the China national ETS commenced in July 2021, six national carbon market were operating. The average carbon price in the 28 markets on 1 April 2021 was USD 16.68. Emissions are the most expensive on the EU ETS, at USD 49.78 per tonne, while the average price of the eight pilot markets were merely USD 3.83[26].

The carbon price is subject to the emission trading scheme, economic structure that determines the feasibility to decarbonize, and the climate change target of a jurisdiction, but EU and South Korea’s paths show that with the cutting down of allowances and the governments’ announcement of more ambitious decarbonization targets, carbon prices generally rose[24]. In addition, an analysis by the International Energy Agency (IEA) suggests that carbon price should be between USD 75 and 100 by 2030 and between 125 and 140 by 2040 to meet the Paris Agreement goals[27].

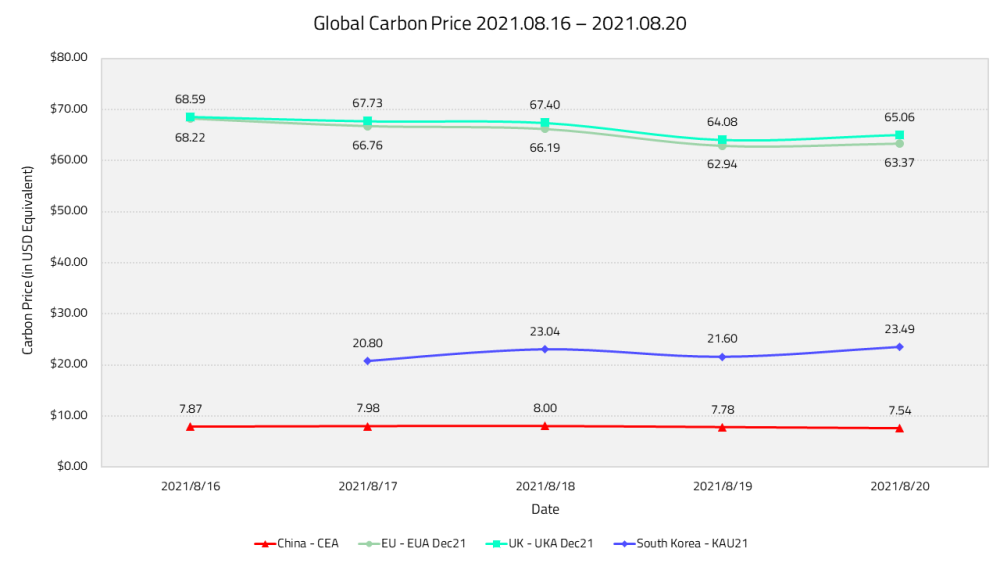

Figure 6 Carbon Prices of China, EU, UK, and South Korea 2021.08.16 – 08.20 (USD Equivalents)

In this case, we compare the carbon price on China national ETS with that on the EU ETS, UK ETS, and Korea ETS, from 16 August to 20 August 2021.

From the comparison, it is evident that despite the EU and the UK each has its own carbon market, a high degree of co-movement of their prices is spotted. The average price of EUA Dec21 futures on during the five trading days was EUR 55.90 (USD 65.50), while that of the UKA Dec21 futures on the was GBP 48.52 (USD 66.57). The carbon price in South Korea was much lower than that in the EU and the UK, but higher than in China, with an average price of KAU21 being KRW 26,175 (USD 22.23).

Carbon price expected to be above CNY 100 when the country reaches peak emissions

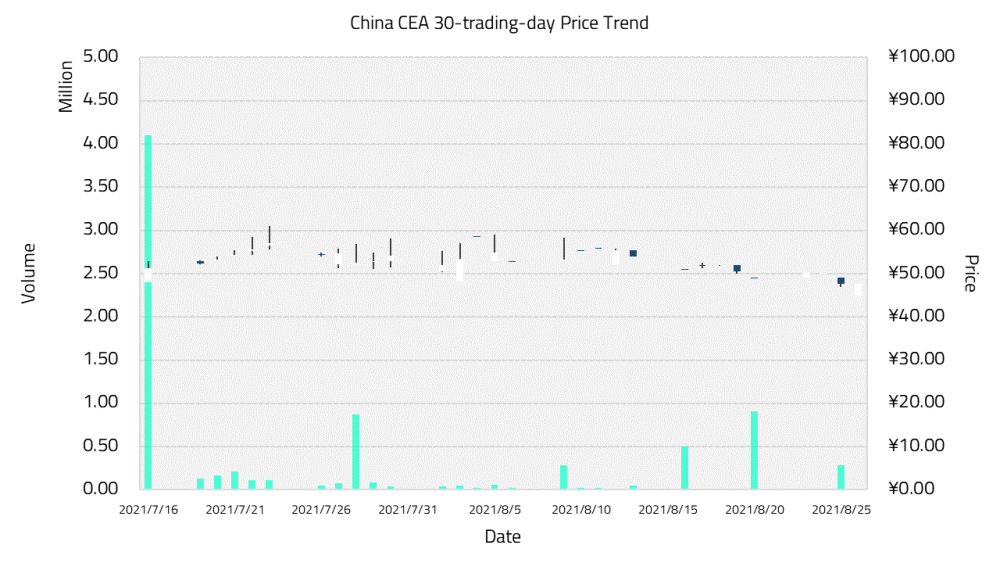

Table 5 Industrial Estimates of China Carbon Price by 2030

A series of research outputs have given their estimates of the long-term trend of the Chinese carbon price. After conducting a market survey, China Carbon Forum concluded in its report “2020 Carbon Pricing Survey” that a reasonable price of emission in China would be CNY 93 per tonne by 2030, and CNY 167 by 2050 [6]. Refinitiv estimates a higher 2030 estimate at CNY 161 per tonne[7]. Xiliang Zhang, member of Institute of Energy, Environment and Economy at Tsinghua University, predicted that China carbon price will reach USD 13 by 2030 and then soared USD 115 by 2050[8]. Researchers at Sinolink Securities allege that the carbon market will account for 0.4% of China’s nominal GDP by 2030 based on EU data, and China carbon price will be between CNY 80 and 120 depending on China's GDP by 2030[17].

Figure 7 Industrial Estimates of China Carbon Price from 2025 to 2060