Greener space or cleaner energy: solar rollout hitting obstacle in Europe

The Europe's ambition of massive solar farm rollout to obtain energy security and lower emissions is going against its countries' regulation to preserve the natural environment. According to the Wall Street Journal, strict French regulation on where solar farms can be built is costing years for a project to be approved. Local government officers in Spain is dragging the expansion of solar power projects out of environmental concerns.

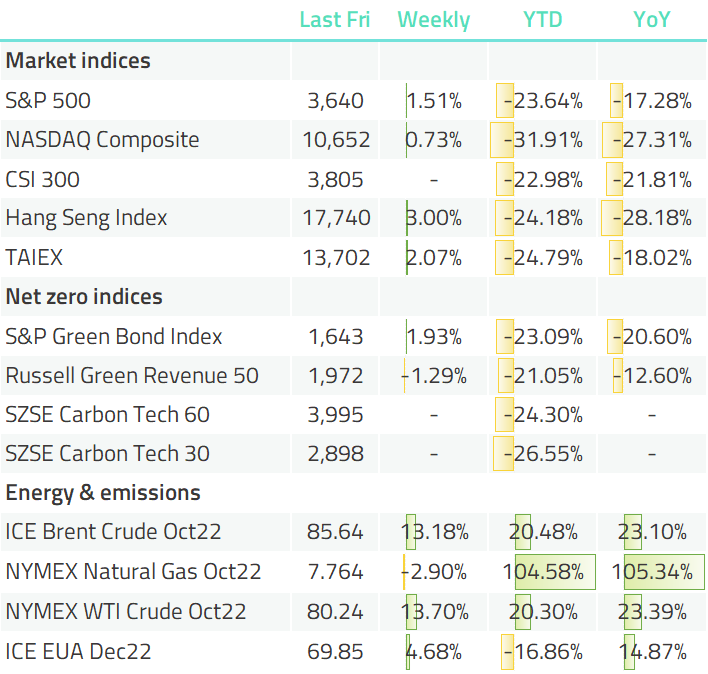

The report mentioned the European Union is counting heavily on solar energy as a key contributor to its climate goals and energy security amid the soaring gas prices. The bloc is targeting its energy supply to be 45% renewable by 2030. Analysis showed that the goal means a triple growth of its solar power capacity. Data from International Energy Agency shows that solar photovoltaic accounted for 3.7% of Europe's electricity generation as of 2019.

Chart: Electricity generation by source in Europe

![]()

Germany's largest power company to exit coal by 2030, pocketed US renewable projects in USD 6.8bn deal

Germany's largest power company RWE has decided to move its coal phase-out deadline by eight years to 2030, in parallel with the government's latest target, but the company will temporarily increase the use of coal-fired power plants in light of the energy crisis in Europe. "At the same time, we are investing billions of euros to accelerate the energy transition and are ready to phase out lignite by 2030," Markus Krebber, the company's CEO said. According to Reuters, Krebber said the company is not requesting additional compenstion for accelerating the process. When the company promised the plan to exit coal by 2038, it was granted a EUR 2.6bn (USD 2.5bn) compensation.

Last week, RWE has also acquired Con Edison's clean energy business in a USD 6.8bn deal. The deal will nearly double RWE's renewables portfolio in the US to over 7GW and increase its US project pipeline by 7 GW to more than 24 GW, Reuters reported. Notably, solar will account for 40% of RWE's US portfolio, up from the current 3%.

![]()

Financing renewables: Impax partners with solar power developer, Taiwan introduced trust deal to clean power purchase

London-based asset manager Impax and Dublin-based solar power developer BNRG have announced a partnership. According to Renews, the partners seeks to acquire 1GW of solar power projects in the US and Ireland, featuring prominently 70MW of projects in the US state of Maine.

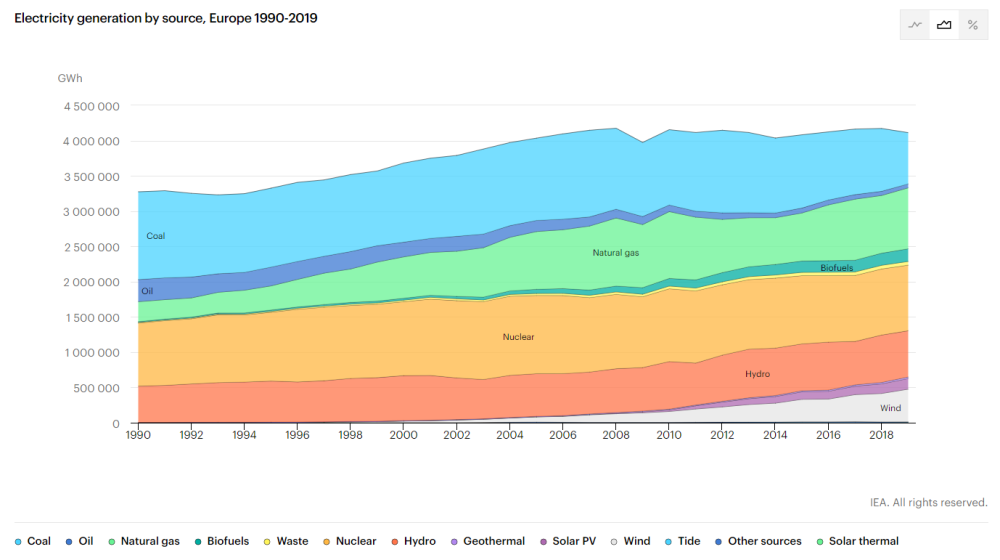

Picture: The State of Maine marked on a map of the US

In Taiwan, a new approach to facilitating low-carbon energy adoption is being explored as to integrate trust deals into clean power purchase. According to a local media, Sunny Founder, a Taiwan-based clean power supplier has helped secure financing for J&V Energy to construct its solar farms, a power generator through a renewable energy trust scheme provided by Sinopac Financial Holdings, a bank. Under the scheme, the fund to finance the construction of solar farms and the future electricity tarifffs to be paid by end users will both go to a dedicated trust account managed by the bank. This approach can reportedly reduce the credit risk of the electricity marketplace that blocks renewable energy generators from getting loans and also avoid the possibility of the fund being misused.

![]()

Chinese central firms asked for a plan to reach peak emissions

Beijing has once again highlighted the transition to carbon neutrality as SASAC, the State Council's office that oversees state-backed firms requires every one of the country's central firms to formulate its own plan to reach peak emissions.

This follows SASAC's guidelines in August which asks central firms to establish carbon inventory and information disclosure systems.

In May, a plan by the SASAC aiming to improve the development of central firms mentioned that central firms should all disclose ESG information by 2023.

![]()

NIO to offer cars in more European nations, for rental only

NIO has on October 7 launched its entry into Germany, Netherlands, Denmark and Sweden by having its cars open for rental only.

According to Caixin, NIO is promoting what it called subscription mode, which is a combination of car leasing and service subscription, which customers will pay for as a whole. Under the subscription, customers can use the car but do not own it. This follows NIO's launch in Norway back in last May, where it has been actually selling cars. Wiliam Li, NIO's CEO said around 60% of the luxury cars were offered as a subscription in the four markets and NIO's move is a result of its market research.

NIO delivered 31,607 cars in the third quarter, its best quarterly result ever, up by 29% YoY, its latest disclosure showed.

Picture: NIO advertised its launch event in Berline on official website

![]()

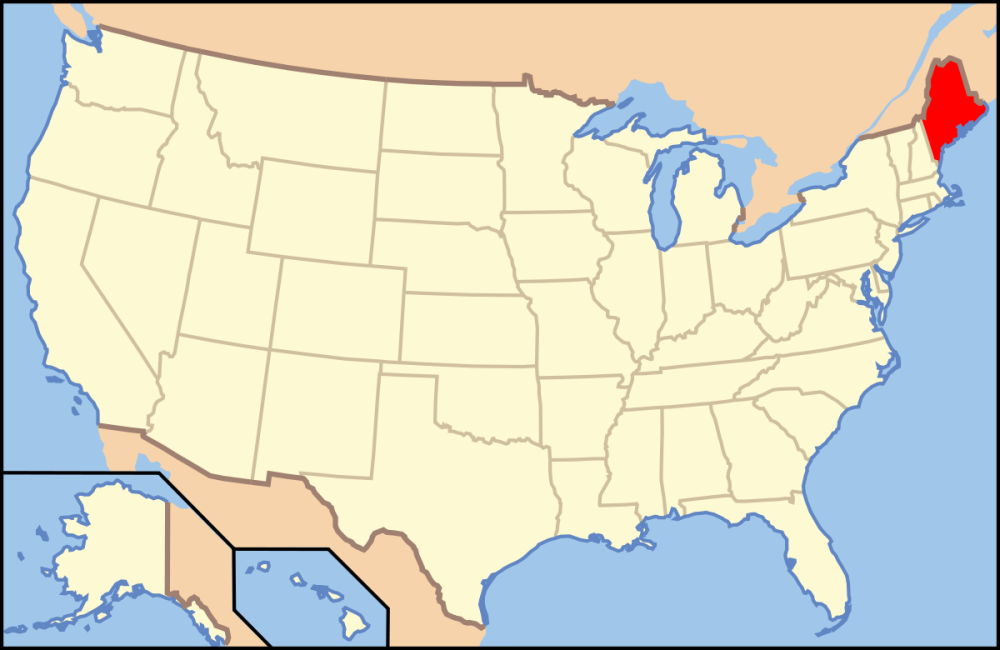

Tesla posts strong sales growth, credit rating upgraded by S&P

The electric vehicle maker Tesla has released its results for the third quarter of this year. The carmaker delivered combined 325 thousand units of Model 3 and Model Y, up by 40% YoY and 36% more than the previous quarter. While 18,672 units of the more pricey Model S or Model X were sold in the three months to September 30, which marks a 101% growth compared to the same period of last year and a 16% quarterly growth.

Chart: Tesla's 22Q3 results

The sound quarterly results has caught the eyes of credit rater S&P Global, who following Tesla's release, announced to move its rating up from BB+ to BBB. S&P Global said the carmkers' sales performance since the beginning of this year is beyond expectation and its productivity is growing at a pace to be able to meet its demands in 2023, securing its dominance in the EV market.

The rebound of factory activities in Shanghai has boosted Tesla's performance in China, with 83 thousand cars delivered in China in September, 8% higher than the previous month, according to the Financial Times citing data from China Passenger Car Association, but less than the counrtry's local top manufacturer BYD with over 200 thousand electric cars. Analysts from Morgan Stanley perceived the slowdown of sales growth rate as a sign that Tesla is reaching its peak in China:"We believe Tesla is passing through its ‘peak China’ dependency stage over the next 12 months".

![]()

WhatsApping about work costs big US banks 1.1bn dollars

Banks including Goldman Sachs, Citi, Bank of America and Morgan Stanley have agreed to pay the Securities and Exchange Commssion collectively USD 1.1bn in penalty for failing to monitor its employees using "unauthorised" tools for work-related communication.

Banks including Goldman Sachs, Citi, Bank of America and Morgan Stanley have agreed to pay the Securities and Exchange Commssion collectively USD 1.1bn in penalty for failing to monitor its employees using "unauthorised" tools for work-related communication.

Reporting on this matter, Bloomberg commented that finance firms are required to closely monitor workers' communication in case of improper conduct, but the monitoring system has been vulnerable to the emergence of messengers like WhatsApp and the distanced working phenomenon due to the COVID-19 pandemic.

![]()

Managing plastic pollution should not be all on firms, Nestlé CEO said

In an event hosted by Lombard Odier, Mark Schneider, the CEO of Nestlé pushed back claims that consumer good firms like Nestlé should pay for the waste collection where their products are sold, saying that “It shouldn’t have to be us (the private sector) all the time.” According to Eco-Business, a delegate who identified herself as someone from a “small Balkan country” asked Mark how those "producing the waste" would respond to a legally-binding global treaty on plastic pollution. “The budget (for managing plastic waste) of my entire country, let alone the local government in each city, is nothing compared to Nestlé’s budget.”, she said.

Mark said the current extended producer responsibility (EPR) has already placed a great part of the responsibility of waste collection and management on the shoulder of firms, while it should be a shared responsibility with governments.

The problem with plastic waste is beyond the costs of managing it. The plastic waste might end up being incinerated or in oceans if not properly taken care of, and finally end up in our food or water. According to The Guardian, researchers in Milan, Italy have found microplastics in human breast milk for the first time. Of the samples of 34 mothers, around 75% of them were found to contain microplastics.

Despite such allegation from the CEO, Nestlé has unveiled two sustainability initatives last week:

- Its Quality Street sweet and Kit Kat chocolate sold in the UK will switch to recycable packaging, with Quality Street changing from foil to recycled paper while Kit Kat using recycled plastic for packaging.

- The company will invest CHF 1bn (USD 1bn) by 2030 to support its Nescafé Plan 2030 to improve sustainable coffee farming and regenerative agriculture practices.

![]()

Meituan plans to offer food delivery service in Hong Kong, labour challenges ahead

Meituan is studying an expansion into the Hong Kong market and recruiting staff in the city, as reported by Sing Tao, the city's local media agency. Hong Kong's food delivery market is basically the ggame between Foodpanda and Deliveroo that respectively accounted for 51% and 44% of the market as of mid-2021, while Uber Eats that used to account for the remaining 5% has exited Hong Kong in late 2021.

The news report suggests that higher cost of workforce will be a major challenge Meituan faces in Hong Kong, citing the strike of delivery riders against Foodpanda over fee rates.

![]()

International aviation to go net-zero by 2050

In the 41st meeting of International Civil Aviation Organisation last week, the global industry union backed by nearly 200 national governments has set a goal to make the interntional aviation a net-zero sector by 2050, in what it calls "long-term global aspiration goal" (LTAG).

Having this goal does not mean memeber states will have to put in a certain share of efforts as ICAO recognise that the development status varies greatly across its member states. Each member state can decide their own plan to form a joint force to reach this goal.

ICAO expects to reach this goal through improvements made in terms of air and ground operations, aviation technologies and the use of fuels.

Picture: Summary of ICAO's work on LTAG

![]()

Munich Re to stop insuring or investing in oil & gas

Last week, Europe's leading insurer Munich Re said it will not have business with new oil and gas projects as part of the support for its recently declared decarbonisation strategy. According to ESG TODAY, a specific timetable is set as to no longer invest in or insure contract or projects exclusively covering the planning, financing, construction or operation of new oil and gas fields that have not had production before year-end 2022, new midstream oil infrastructure, or new oil-fired power plants as of April 2023.

![]()

Connecting workplace: KPMG's global ESG head, Mirova has a deputy CEO

Last week, KPMG announced that it has expanded the role of John McCalla-Leacy, its Head of ESG for the UK, with a new appointment of Head of Global Environment, Social & Governance (ESG). John has spent more than 20 years with KPMG since early 2000s, including two years in KPMG China from 2012 to 2014.

Last week, KPMG announced that it has expanded the role of John McCalla-Leacy, its Head of ESG for the UK, with a new appointment of Head of Global Environment, Social & Governance (ESG). John has spent more than 20 years with KPMG since early 2000s, including two years in KPMG China from 2012 to 2014.

Mirova, a sustainability-focused investment manager under Natixis, has onboarded Guillaume Abel as Deputy CEO, who will be in charge of the work regarding development, sustainability research, finance, risk, legal, compliance and operations at Mirova. Prior to this appointment, Guillaume Abel was working for Ostrum Asset Management, another affiliate of Natixis as Head of Business Development.

Mirova, a sustainability-focused investment manager under Natixis, has onboarded Guillaume Abel as Deputy CEO, who will be in charge of the work regarding development, sustainability research, finance, risk, legal, compliance and operations at Mirova. Prior to this appointment, Guillaume Abel was working for Ostrum Asset Management, another affiliate of Natixis as Head of Business Development.

![]()