Verbund is not exactly a household name in Asia. But on March 24, the Austrian utility brought its first “green bond” to market that was aligned with the European Union (EU) Taxonomy on sustainable finance. A day later, the better-known German energy company E.ON followed suit.

The EU Taxonomy is a classification tool to identify economic activities that are environmentally sustainable. That means companies aligning to the taxonomy – which became effective in law in June 2020 - can only call their projects “green” if they fit EU-recognized criteria to navigate the transition to a low-carbon economy. The framework can help investors to assess whether investments are meeting robust environmental standards and are consistent with high-level policy commitments such as the Paris Agreement on Climate Change. Fund managers and other financial market participants (FMPs) will also have to align with the Taxonomy. From 1 January 2022 FMPs are required to publish a prescribed list of metrics, such as carbon footprints, greenhouse gas emissions and hazardous waste emissions of the underlying companies in their fund products.

The role of the EU Taxonomy is ultimately a guide for scaling up sustainable investment to implement the European Green Deal – the European Commission (EC) policy initiatives aimed at making Europe climate neutral in 2050, which is similar to China’s 2060 target. The Taxonomy provides definitions to companies, investors and policymakers on which economic activities can be considered environmentally sustainable. Its goals are to create security for investors, protect private investors from claims of “greenwashing” through false or misleading information about environmental sustainability, help companies plan their transitions and shift investments where they are most needed.

The taxonomy will likely have an outsized influenced on green investing, one of the fastest-growing investment mandates in both equity and debt. While the taxonomy applies only to EU member states, as the first of its kind globally it could become the template for other economies around the world. Moreover, global companies that raise funds in Europe, or global financial companies operating there, operate financial companies have listed securities trading on European bourses, will need to be compliant

While we expect non-European fund managers selling investment products in Europe to be given some flexibility in meeting reporting standards on the taxonomy, non-European companies and financial market participants could be at a disadvantage by not embracing the framework if it becomes a global benchmark. Such disadvantages could range from higher funding costs relative to EU Taxonomy-aligned companies, to smaller potential investor pools for investment products.

Thus, the framework will likely have much impact beyond Europe. For Asia, this includes Asian companies that operate or raise funds in the EU, and FMPs who sell investment products or provide financial services in the EU. It also has implications for policy in the region. As Asian economies such as Hong Kong and Singapore develop sustainable-finance markets, for example, the template of the EU Taxonomy will be weighed greatly by entities both based in and outside the EU.

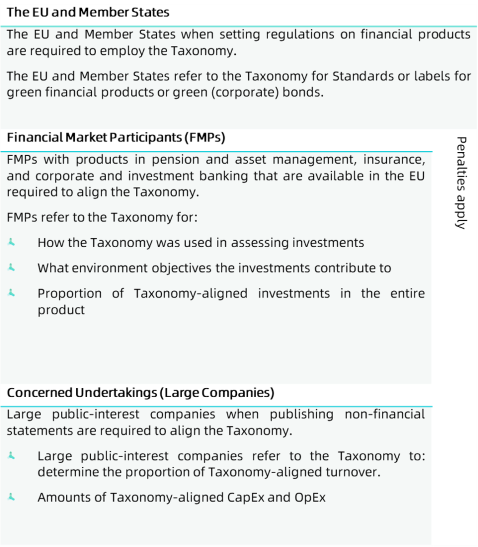

To Whom Does the Taxonomy Apply?

The EU Taxonomy applies to:

What are the environmental objectives?

To be in alignment with the Taxonomy, an economic activity should:

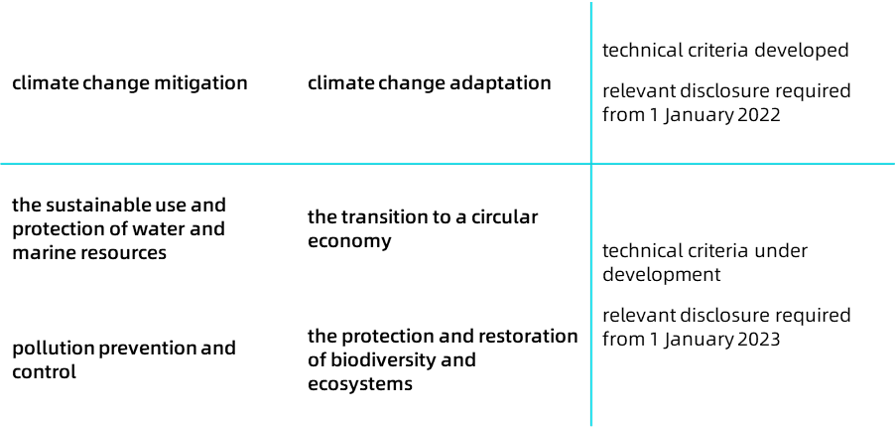

- Contribute substantially to at least one of the six environmental objectives:

However, the EU has developed technical criteria only to guide climate change mitigation and climate change adaptation. Relevant disclosure against the Taxonomy on how an economic activity contributes to climate change mitigation and climate change adaptation will be required from 1 January 2022. Technical criteria for the remaining four objectives are under development and relevant disclosure will be required from 1 January 2023.

In essence, this means that taxonomy covers only a limited number of underlying sectors, at this stage. The following sectors are recognized by the technical criteria as environmentally active:

Economic activities in these sectors are required to align with the Taxonomy. Some sectors with a significant environmental impact, such as aviation, are notably not included. Future amendments are expected.

- Do no significant harm – DNSH – to any of the other environmental objectives.

For subjects with specific Taxonomy-aligned obligations applied to them in the technical framework, a Taxonomy-aligned activity would contribute to at least one environmental objective. However, a subject when contributing to some of the objectives is required to avoid DNSH to the other objectives. For instance, one of the Taxonomy-aligned activity is that passenger cars should maintain tailpipe emissions fewer than 50 grams of carbon dioxide per kilometer, which contributes to climate change mitigation, but in doing so, it cannot do significant harm to other environmental objectives.

The Taxonomy has also attempted to navigate economic production to be sustainable. Taking the manufacture of hydrogen as an instance, direct CO2 emissions from manufacturing of hydrogen needs to be maintained at or below 5.8 tCO2e/t Hydrogen, while electricity use for hydrogen produced by electrolysis cannot surpass 58 MWh/t Hydrogen.

- Complies with the minimum safeguards

Where relevant requirements lack in the Taxonomy, subjects of the Taxonomy align with the following safeguards in carrying out an environmentally sustainable activity:

- OECD Guidelines for Multinational Enterprises

- UN Guiding Principles on Business and Human Rights

- Complies with technical screening criteria (performance thresholds)

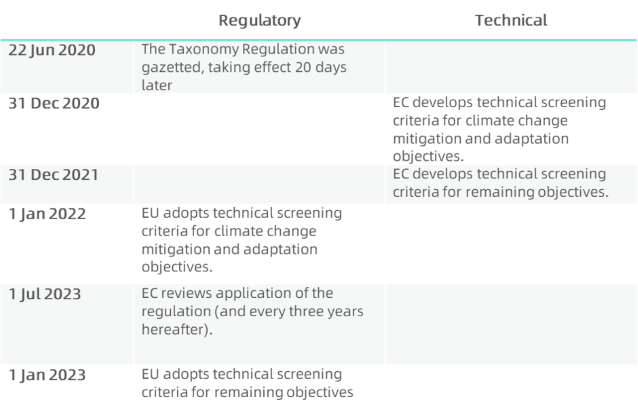

The Taxonomy was published on the Official Journal on June 2020 and entered into force in July 2020. Currently, the EC has been developing technical screening criteria regarding the remaining four objectives, which is scheduled to be completed by 31 December 2021. A general proceeding of the regulation is as follows:

Is alignment with the Taxonomy compulsory in Asia?

For Chinese institutional investors, what appears concerning are whether this is compulsory if they market financial products in the EU and whether investors should worry about the potential adverse impacts on them regarding the alignment with the Taxonomy, such as being requested to change the portfolio of a fund to fit for a higher Taxonomy-aligned ratio.

Chinese asset managers whose major investments are in Asia are still required to align with the Taxonomy if they market their products in the EU. Asset managers are recommended by industry experts to utilize their influence in promoting the alignment of Taxonomy among investees.

Financial products that do not align with the taxonomy might face difficulties in the future as they will have to clearly disclose that they do not consider sustainability risks or factors, or EU Taxonomy criteria that define environmentally sustainable economic activities. That would be even more so if a product were to promote environmental or social characteristics.

What is the timeline for compliance?

Currently, existing issues on data quality, supervision, and international harmonization in the implementation of the Taxonomy by European and international FMPs are recognized by the EU. At this initial stage, FMPs are encouraged to disclose relevant information, even if they contain missing data, or adopt different standards from the EU. They are not likely to get negatively impacted for insufficient disclosure before a better approach to this is imposed by the EU, according to industry experts.

Lower numbers of Taxonomy-aligned ratios are acceptable at present as both transition activities are part of the Taxonomy as well. Investment in transition activities can be disclosed in narrative means. The EU does not assume all the obligations can be fulfilled by international FMPs at the initial stage and the EU would assist FMPs in improving alignment.

Below is an example of how the Taxonomy-aligned ratio is derived of a portfolio:

The ultimate ratio to be expected can be around 70%, but for now a ratio between 5% to 10% is also acceptable, but far from satisfying though.

What are key issues for investors?

- The EU Taxonomy regulation primarily applies to FMPs and large companies in the EU. Entities headquartered in the EU shall be required to align with the Taxonomy for both their EU and non-EU operations.

- For non-EU companies, their operations in the EU, if there are, have to align with the Taxonomy, but not their global operations. For FMPs, besides EU operations, the financial products they market in the EU, if they have, are subject to the Taxonomy.

- The Taxonomy is a large-scale and comprehensive regulation on sustainability. Issues on data quality or standards will undoubtedly emerge. FMPs who do not currently meet the requirements can still continue their activities in the EU, but have to demonstrate that a transition is underway, which can be compensated with narrative disclosures.

- The EU is still working on the regulation and resolving issues in implementing the regulation. Concerned entities will be required to fully align with the Taxonomy when it is developed.

Find more about the technical criteria at: Sustainable finance: TEG final report on the EU taxonomy